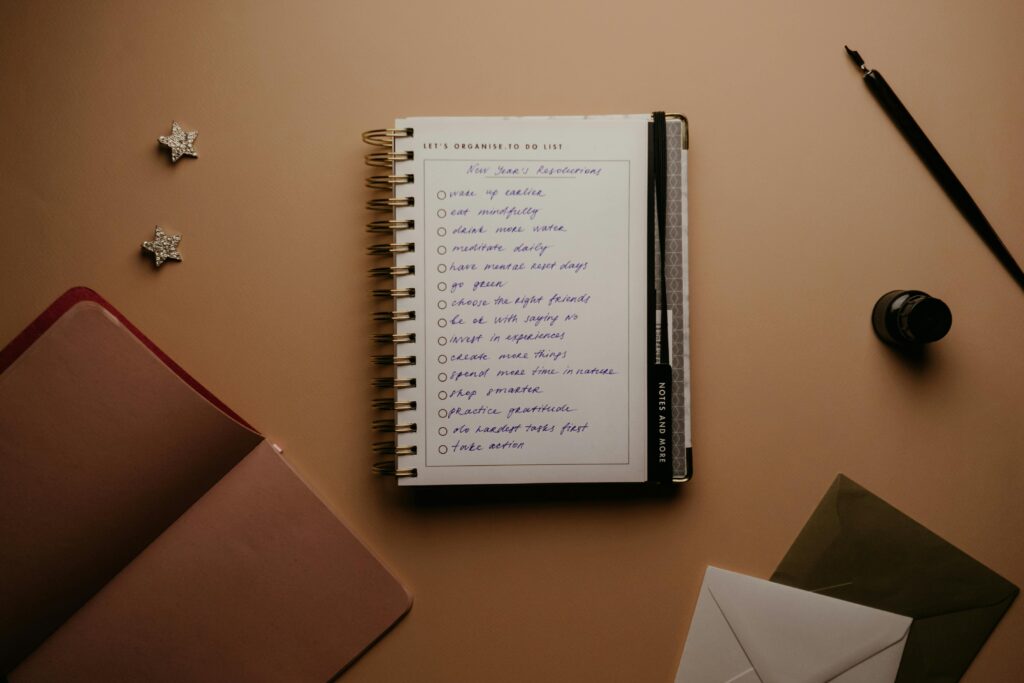

Top Financial Planning Tips for Your New Year Resolutions

The start of a new year brings fresh opportunities to take control of your finances. Whether you’re aiming to grow your savings, cut back on unnecessary expenses, or finally pay down debt, setting smart financial goals can make a huge difference in your life. The good news? You don’t need to be a finance expert to get started. With a little planning and consistency, you can create a financial plan that works for you.

Why Financial Resolutions Matter

We’ve all made New Year resolutions to eat healthier or exercise more. But what about your financial health? Just like your physical and mental well-being, your financial wellness needs care and attention.

Think of your finances like a roadmap. Without a clear direction, it’s easy to get lost. That’s why having a plan in place—especially at the start of the year—can set the tone for the months ahead. When you’re clear about your financial goals, you’re more likely to make smart decisions with your money.

Simple Financial Planning Tips to Start the Year Strong

If you’ve been meaning to get your finances in order, these practical tips can help you stay on track. Let’s break it down into manageable steps:

1. Set Clear, Achievable Goals

Before diving into budgets and spreadsheets, take a moment to figure out what you want your money to do for you this year. Maybe you want to:

- Build an emergency fund (3–6 months of expenses is ideal)

- Pay off high-interest debt, like credit card balances

- Start investing for your future

- Save for a home or a big life event

Keep in mind, your goals should be specific and realistic. Instead of just saying, “I want to save more,” try, “I want to save $200 a month for an emergency fund.” It’s hard to hit a target if you can’t see it!

2. Understand Your Money Flow

How well do you know your monthly income and expenses? Most of us have a general idea, but creating a simple budget can offer clarity. Here’s an easy way to start:

- List all your sources of income – your job, side gigs, anything extra

- Track your expenses – housing, groceries, transportation, subscriptions, and so on

Many people are surprised by how much they spend on things like takeout or streaming services. Small changes add up quickly—just like compound interest!

3. Build or Boost Your Emergency Fund

If the past few years have taught us anything, it’s that life is unpredictable. Having an emergency fund gives you a safety net in case of job loss, car repairs, or medical bills. Think of it as your financial buffer.

You don’t have to save it all at once. Try setting aside a small amount every paycheck. Even $25 a week adds up to $1,300 in a year!

4. Review and Reduce Debt

Debt can feel like a weight on your shoulders—but it doesn’t have to. Start by understanding what you owe and to whom. Then prioritize paying off high-interest debts first. Consider the avalanche method (highest interest first) or the snowball method (smallest balance first) to build momentum.

Also, if you’re carrying credit card debt, reach out to your provider to ask about lowering your interest rate. You’d be surprised how often a simple call can help.

5. Maximize Your Investments and Retirement Contributions

If your employer offers retirement plans like a 401(k), especially with matching contributions—don’t leave that free money on the table! Even if you can’t contribute the full amount, putting in what you can now pays off big time later.

Thinking long-term might not always feel urgent. But the earlier you start investing, the more time your money has to grow.

6. Plan for Big Life Goals

Do you have a wedding, family trip, or home purchase in your near future? Start planning for those now. By setting aside money ahead of time, you can avoid relying on credit cards or loans later on.

Open a dedicated savings account for each goal if it helps you stay organized. Out of sight, out of spend!

Use Tech to Stay on Track

Managing your finances doesn’t have to mean paper receipts and complicated spreadsheets. Many apps and tools are designed to help you:

- Track your spending and savings goals

- Set reminders for bill payments

- Monitor your credit score

Some people love budgeting apps like Mint or You Need a Budget (YNAB), while others prefer using their bank’s built-in tools. Find what works for you—and stick with it.

Regular Check-Ins Keep You Accountable

Your financial goals shouldn’t be out of sight once February hits. Try scheduling a quick monthly “money check-in” to review your progress, adjust your budget, and celebrate small wins.

If you’re feeling stuck, consider talking to a financial advisor. Think of them like a personal trainer for your money—they can help you build a plan, stay motivated, and get results.

Final Thoughts: Small Steps, Big Impact

Here’s the truth: Financial planning doesn’t have to be overwhelming. Taking small, consistent actions throughout the year can lead to big progress. Whether it’s stashing spare change into savings or cutting back on subscriptions you rarely use—every bit counts.

So, what’s your top money goal this year? Whatever it is, remember—you don’t need to be perfect. You just need to get started.

Quick Recap: Financial Planning Tips for a Strong New Year

- Set specific, actionable financial goals

- Track income and expenses to create a budget

- Build an emergency fund for unexpected costs

- Focus on paying down high-interest debt

- Invest early and increase retirement contributions

- Save in advance for large expenses or life milestones

- Use financial tools or apps to stay organized

- Review your plan regularly and adjust as needed

Here’s to making 2024 your most financially confident year yet. You’ve got this!